are funeral expenses tax deductible in 2020

As a society we give nearly 2 of our personal income to charities and nonprofit organizations. Depending on income and family status the taxpayer may be able to deduct an amount that exceeds a certain percentage of ones income.

Amber Wedding Seating Chart Template Printable Seating Etsy Seating Chart Wedding Template Seating Chart Wedding Wedding Posters

For tax purposes the law classifies charities and nonprofits according to their mission.

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

. Under legislation enacted by the General Assembly Virginias date of conformity to the federal tax code will advance to December 31 2021. 463 for information on deductible expenses while traveling away from home. In insurance the insurance policy is a contract generally a standard form contract between the insurer and the policyholder which determines the claims which the insurer is legally required to pay.

A motor vehicle except a hearse you bought to use in a funeral business to transport. Insurance in the United States refers to the market for risk in the United States the worlds largest insurance market by premium volume. John properly filed his 2020 income tax return.

As of 2020 the maximum yearly 401k contribution is 19500. He died in 2021 with unpaid medical expenses of 1500 from 2020 and 1800 in 2021. A motor vehicle you bought to use more than 50 as a taxi a bus used in the business of transporting passengers or a hearse in a funeral business.

Retirement Accounts That Allow Pre-tax Contributions. In 2020 the limit for joint filers was 24800 and 12400 for single filers. You will find details on 2020 tax changes and hundreds of interactive links to help you find answers to.

If the corporation is using the California computation method to compute the net income enter the difference of column c and column d on Schedule F line 17. Actual results will vary based on. The most significant thing to do is comparison shop and plan your funeral ahead of time.

Youll also have to budget for the funeral director fees of approximately 1500 as well as embalming expenses of about 500. Since you need to itemize this deduction it only qualifies for deduction if the sum of all your itemized deductions isnt higher than your standard deduction. This means if you go over that amount youll have to include that money in your taxable income for the year and pay double tax on the excess amount unless the money is removed in the time permitted.

Fees of executor or administrator. Enter the nature of the tax the taxing authority the total tax and the amount of the tax that is not deductible for California purposes on Form 100W Side 4 Schedule A. However there is a common misconception that all nonprofits are qualifying charitable organizations - but that isnt always the case.

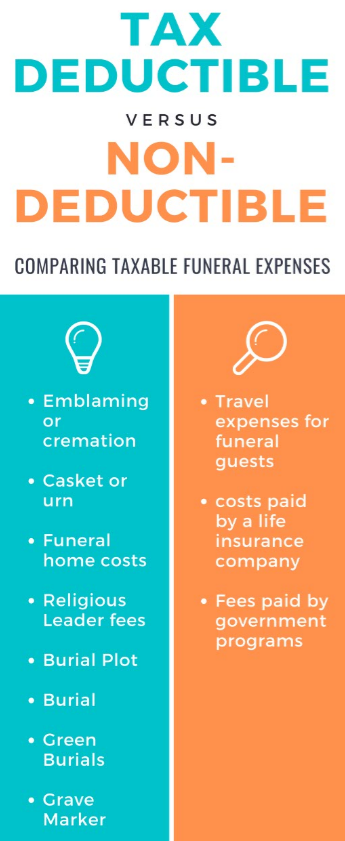

Burial or funeral expenses including the cost of a cemetery lot. By contrast a pre-paid funeral plan requires you. A motor vehicle except a hearse you bought to use in a funeral business to transport passengers.

Find forms instructions and publications. If you paid for funeral expenses during the tax year you may wonder whether you can deduct these costs on your federal income tax return. Funeral insurance is a guaranteed product that provides financial assistance to your family when you pass away.

According to Swiss Re of the 6287 trillion of global direct premiums written worldwide in 2020 2530 trillion 403 were written in the United States. Insurance generally is a contract in which the insurer agrees to compensate or indemnify. In short these deductible items are expenses incurred during the settlement of the estate but not beyond the last day prescribed by law or the extension thereof for the filing of the estate tax return.

Enter the amount of deductible expenses you have as a partner that you did not deduct elsewhere on. A motor vehicle you bought to sell rent or lease in a motor vehicle sales rental or leasing business. The money can be used to pay for your funeral or any other expenses as soon as they arise.

Beneficially any resident who incurs extraordinary expenses may also obtain some tax relief. Enter the nature of the tax the taxing authority the total tax and the amount of the tax that is not deductible for California purposes on Form 100 Side 4 Schedule A. In addition to the deductions below Virginia law allows for several subtractions from income that may reduce your tax liability.

If the expenses are paid within the 1-year period his survivor or personal representative can file an amended return for 2020 claiming a deduction based on the 1500 medical expenses. However funeral expenses cosmetic surgery and over-the-counter medications arent deductible. In exchange for an initial payment known as the premium the insurer promises to pay for loss caused by perils covered under the policy language.

Pays for itself TurboTax Self-Employed. Gifts to a non-qualified charity or nonprofit. See Tax Bulletin 22-1 for more information.

Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020. The casket is one of the most costly items for burial and costs begin at 2000 and may go higher. These unavoidable expenses include funeral costs stays at Austrian hospitals and special medical treatments.

If the corporation is using the California computation method to compute the net income enter the difference of column c and column d on Schedule F line 17. If in 2021 you receive a GSTHST rebate for the 2020 tax year you have to include the amount of the rebate on your income tax return. Judicial expenses may include.

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos

Are Funeral Expenses Tax Deductible

Can The Cra Pursue The Beneficiary Of Your Life Insurance Under Section 160 Of The Income Tax Act A Canadian Tax Lawyer S Analysis

5 Tax Advantages Every Business Owner Should Know Macdev Financial

Frequently Asked Questions Faqs

Entrepreneur On Instagram Follow Complete Entrepreneur Follow Complete Entrepreneur Money Management Advice Budgeting Money Investing Money

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Are Funeral Expenses Tax Deductible

Estate Planning Checklist Estate Planning Checklist Funeral Planning Checklist Funeral Planning

Are Funeral Expenses Tax Deductible

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Canada Revenue Agency Tax Tip Eight Things To Remember At Tax Time Lifestyles Thesuburban Com

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Can You Claim Funeral Or Burial Expenses As A Tax Deduction For 2019 Cake Blog

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More