starting credit score in india

You have to give yourself 6 months to a year for your repayment history to reflect as a credit score. The more you score to achieve 900 the greater you get credit card approval process.

What Is A Good Credit Score Forbes Advisor

A score above 750 is considered to be an excellent score.

. Incepted in 2016 QuickCredit concentrates on catering the working-class individuals in SME MSME and MNCs who have either a low credit score or no credit score. These bureaus use their algorithms based on the following credit aspects to calculate your credit score in India. For example most mortgages require a minimum credit score of 620 or even as low as 500 for an FHA or bad credit loan.

The score is derived using information from all past credit transactions and loans. How to Start a Credit Score. Without any credit history reports and scores wont magically burst into.

Starting with no credit score doesnt mean your score is zero. Its d none of the above. What one lender may consider an unacceptable score another may accept.

Without an established history your credit report and credit score dont magically appear when you turn 18 despite many common misconceptions. A score of 0 on a CIBIL credit report means Credit History Not Available NA which indicates that the credit history is less than six months which is not sufficient to give a credit rating between 300 and 900. You will get a first credit score after a few months of credit history 3-6 months.

The basic eligibility for loans in India includes. In fact the lowest possible score from FICO or VantageScore is 300. Banks check your CIBIL Score before approving your loan.

But dont be disheartened as everyone starts out with a blank slate when it comes to building a credit score. The closer the. Credit scores are computed by four major credit bureaus in India including TransUnion CIBIL Equifax Experian and CRIF Highmark.

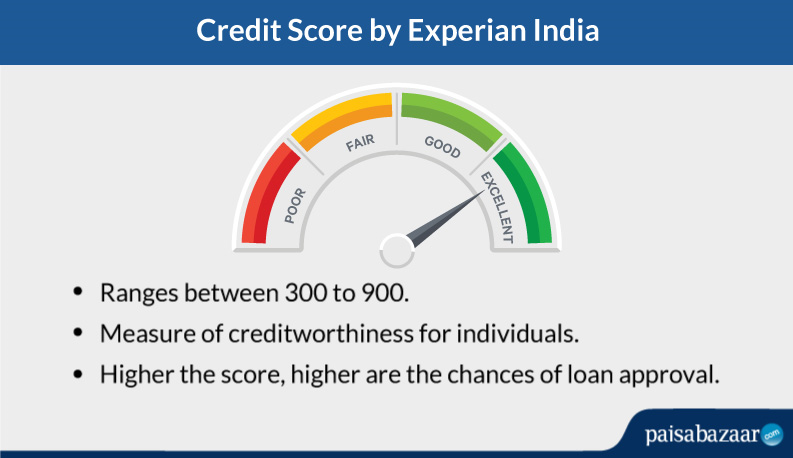

Here we explained about what is good credit score in India and cibil score check. A good credit score is considered to be more than 750. This score ranges from 300 to 900 with 900 being the best score.

Top Credit Scoring Startups In India That Use AI Lendingkart. October 27 2021 4 min read. If youre ready for your first credit card it may help you get started.

Get a credit card against FD in a bank. In India CIBIL or Credit score plays a very significant role in getting any kind of loans from any lender. Credit score is a 3-digit number ranging between 300 to 900 where a score closer to 900 is generally considered to be a good score.

Building a credit history will start you on your way to having a credit score. Your Credit Score Doesnt Start at Zero. John S Kiernan Managing EditorFeb 15 2016.

A credit score is a number that is assigned to people and businesses that have a financial history of borrowing and repaying debt. Expect your initial rating to fall to around 670 because you automatically perform poorly on three factors that combine to influence 45 of your number. This score will be based on those 6.

In reality everyone starts with no credit score at all. Many banks in India like ICICI Bank Axis bank etc. Offer you a credit card once you have opened a fixed deposit FD with them.

We check whether the person is salaried irrespective of credit score if they receive salary they are. Check your free CIBIL Score and Report and apply for a customized loan. The company has begun serving every Tier 1 and Tier II city in Hyderabad.

The truth is that we all start out with no credit score at all. Thats because your credit score doesnt start at zero. Once you get your first credit card or loan etc.

Parameters That Credit Bureaus Use to Calculate Your Credit Score. CIBIL Score is a 3 digit number extend between specified limits from 300 to 900. A good credit score is a key to get a wide spectrum of credit cards and quick loan approvals.

There is no starting credit score per se. There are predominantly four credit bureaus TransUnion CIBIL Experian Equifax and CRIF High Mark operating in India. But unless youve had some.

If you get a credit card and start using it and pay the balance off every month which shouldnt be much then after 3 months your starting credit score of no record found will now be too new to rate. Lendingkart Finance is a non-deposit taking NBFC which provides working capital loans and business loans to. Top 7 Tips to Build your Credit Score Tip 1 Apply for a Credit Card.

Founded in 2013 by Gaurav Hinduja and Sashank Rishyasringa Capital Float is one of the leading Fintech. Here are a few tips that will help you build a good credit history from start. Although all the four credit information companies have developed their individual credit scores the most popular is CIBIL credit score.

When you check your credit score for the first time you might be surprised to find a three-digit number even if youve never used credit before. If it makes sense for you you might want to consider applying for a card with no annual fee. CIBIL Score is the credit score issued by CIBIL Indias first credit bureau and ranges between 300 to 900.

Credit scores are based on the information in our major credit reports and such reports arent even created until weve had credit eg a credit card or loan in our names for at least six months. Do you begin at a the highest possible credit score b the lowest or c somewhere in between. Your starting credit score will fall below the median number of 723 even if you pay all of your obligations on time and according to terms during the six-month evaluation period.

It can go up pretty quickly as long as. Thats because your credit score doesnt start at zero. Remember that the system is relative.

- Connect your SSN to your bank account - You open new credit cards - You make sure your credit utilization rate is below 30 ideally 10 - You make full payments on time. The CIBIL credit score is a three digit number that represents a summary of individuals credit history and credit rating. You dont immediately have a credit score.

This is a good way of getting a credit card to build your credit score. After 6 months however you will finally have a score. The answer may surprise you.

But to open the line of credit you need to build a credit history the right way.

Two Wheeler Loan Its Features Personal Loans Online Instant Loans Online Loan

Steps To Achieve Perfect Credit Boost Credit Score Fico Score Credit Score

If You Don T Maintain Your Cibil Score Then Your Credit Won T Help You In The Future To Improve Your Cibil Score Credit Restoration Easy Loans Credit Score

Everything You Wanted To Know About Cibil Start Saving Money Free Credit Score Credit Score

Low Cibil Score Can Make Your Financial Life A Nightmare In 2021 Life Financial Literacy Financial

Why Pay For Cibil Report Apply For Free Credit Report Free Credit Score Credit Score How To Apply

Goodcibilscore Depend On Your Credit History Better Your Credit History Higher The Cibil Score Improve Your Credit Score Credit Score Personal Loans

A Cibil Score Is The Most Important Criteria For You To Get Access To Credit Products Factors That Affec Credit Repair Services Good Credit Credit Restoration

Top Credit Scoring Startups In India That Use Ai Credit Score Start Up Financial Institutions

Do You Know A Low Cibil Score Can Literally Change Your Life Scores Did You Know Change

Experian Credit Score Check Free Experian Cibil Score Get Credit Report

This Pie Chart Shows How Much Different Kinds Of Behavior Contribute To Your Fico Score Fico Score Pie Chart Reward Card

Do You Want To Improve Your Cibil Score In India Here Are Some Important Tips That Helps You Improve Your Credit Score Check And Balance Loans For Poor Credit

Pin By Fundstiger Finance On Credit Score Loans For Poor Credit Loans For Bad Credit Business Loans

How To Get A Personal Loan When You Don T Have Good Credit History Credit History Good Credit Personal Loans

How To Maintain A Cibil Score For A Business Business Loans Good Credit Business

What Is Cibil Score Or Credit Score Best Tips 2021

How Much Is Cibil Score Required To Finance Your Car Credit Score Bad Credit Score Scores

Improve Credit Score Improve Credit Improve Credit Score Credit Score